1. Centralized Exchange (CEX): A brainless financial management solution that is friendly to novices

Take Binance, OKX, Gate.io, and Bitget (February 28) as examples:

Binance: The real-time annual interest rate of USDT single-currency financial management is temporarily reported at 2.4%, the annual interest rate of Tier 1 (0-500 USDT) is temporarily reported at 7%, and the annual interest rate of Tier 2 (500-5000 USDT) has an additional 2% bonus, and the estimated annual interest rate is between 1.9% and 9.4%;

The real-time annual interest rate of USDC single-currency financial management is temporarily reported at 1.63%, the annual interest rate of Tier 1 (0-500 USDC) is temporarily reported at 10%, and the annual interest rate of Tier 2 (500-10,000 USDC) has a 3% bonus, and the estimated annual interest rate is 11.62%;

The real-time annual interest rate of FDUSD single-currency financial management is temporarily reported as 1.43%, and the annual interest rate of Tier 1 (0-400 FDUSD) is temporarily reported as 8%, with a minimum investment of 0.1.

OKX: The real-time annual interest rate for USDT single-currency financial management is temporarily reported as 5%, and the real-time annual interest rate for USDC single-currency financial management is temporarily reported as 5%, with a minimum investment of 0.01.

Gate.io: The real-time annual interest rate for USDT single-currency financial management is temporarily reported at 3.96%, with an additional 10% bonus of equal value in $GT. The tiered annual interest rate changes with the number of days deposited, 3 days is temporarily reported at 2.89%, 7 days is temporarily reported at 3.42%, 14 days is temporarily reported at 3.68%, and the minimum investment is 1; USDC single-currency financial management is temporarily reported at 5%, with a minimum investment of 1.5.

Bitget: USDT single currency investment is temporarily reported at 5.96%, with an additional 8% bonus within 0-500 USDT.

CEX products are simple to operate, flexible in deposits and withdrawals, and friendly to novices. The interest rates of Binance/OKXs current products are similar. Gate.io USDT has an annualized return of 3.9% + an additional reward of 10% platform currency GT.

2. Basic lending on the chain: fixed deposits in the DeFi world

Mainstream lending on the chain (taking the base interest rate on February 28 as an example):

Ethereum

Aave V3: USDT 3.48%; USDC 3.93%; DAI 4.75%;

Compound V3: USDT 4.53%; USDC 4.48%;

Yearn Finance: USDT 4.56%; USDC 4.36%; DAI 10.38%;

Uniswap V3: USDC-USDT LP 19.01%; DAI-USDT LP 19.13%;

Morpho Aave: USDT 7.21%; USDC 5.02%;

Flux Finance: USDT 4.79% 4.89%;

Fluid Lending USDT 4.34%; USDC 4.30%;

Spark: USDT 5.53%; USDC 4.77%; DAI 5.91%;

Solana

Kamino Lend: USDT 2.88%; USDC 5.28%;

NX Finance: USDT 10.85%; USDC 7.45%;

Pluto: USDC 6.19%;

Vaultka: USDT 20.83%; USDC 16.34%

Francium: USDT 16.49%.

BSC

Venus Core Pool: USDT 4.83%; USDC 5.85%;

Wing Finance: USDC 5.92%

Base

Aerodrome Slipstream: USDT 8.12%;

Morpho Blue: USDC 5.47%;

AAVE V3: USDC 4.23%

Fluid Lending: USDC 2.35%;

Note: The above data comes from DefiLlama, dated February 28.

3. Special session for advanced players: dismantling the financial Lego of income

Pendle: Futuresization of Yields

Pendle is a decentralized protocol that allows users to split their assets into principal and yield tokens, increasing their yields.

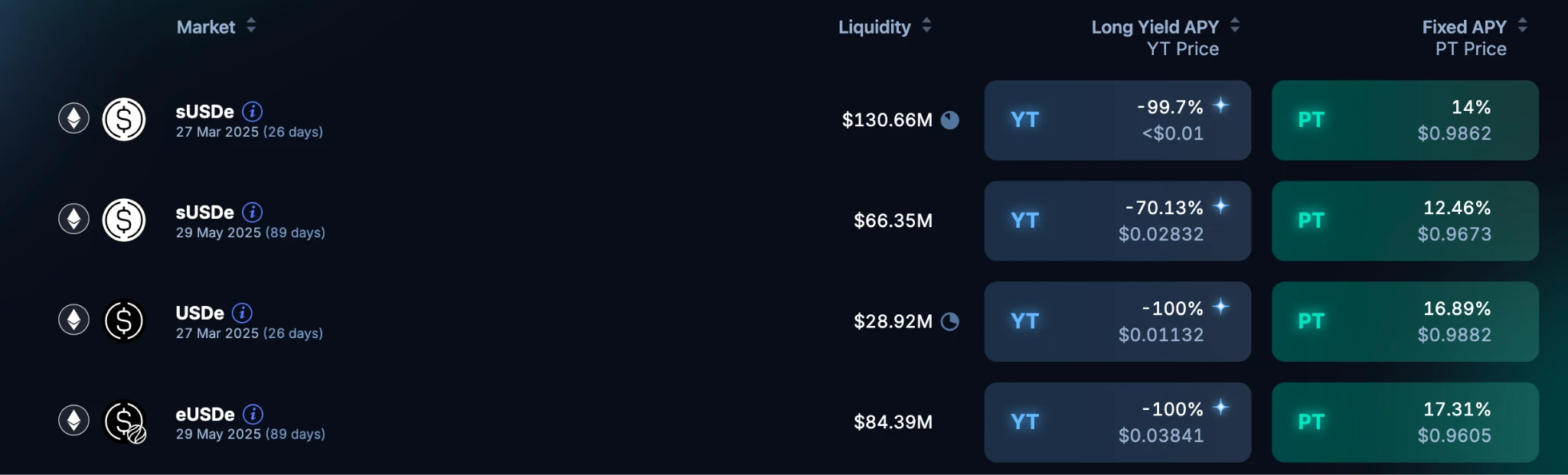

Through Pendle, users can split assets (such as stablecoins) into two parts: ownership (Ownership Token, referred to as OT) and yield (Yield Token, referred to as YT), and trade them independently. For example, deposit sUSDe into Pendles yield pool (YT) to obtain yield tokens (PT). After maturity, PT can be exchanged back to sUSDe at a ratio of 1: 1, with an annualized yield of about 14%. Similarly, using USDe can obtain an annualized yield of about 16.89%.

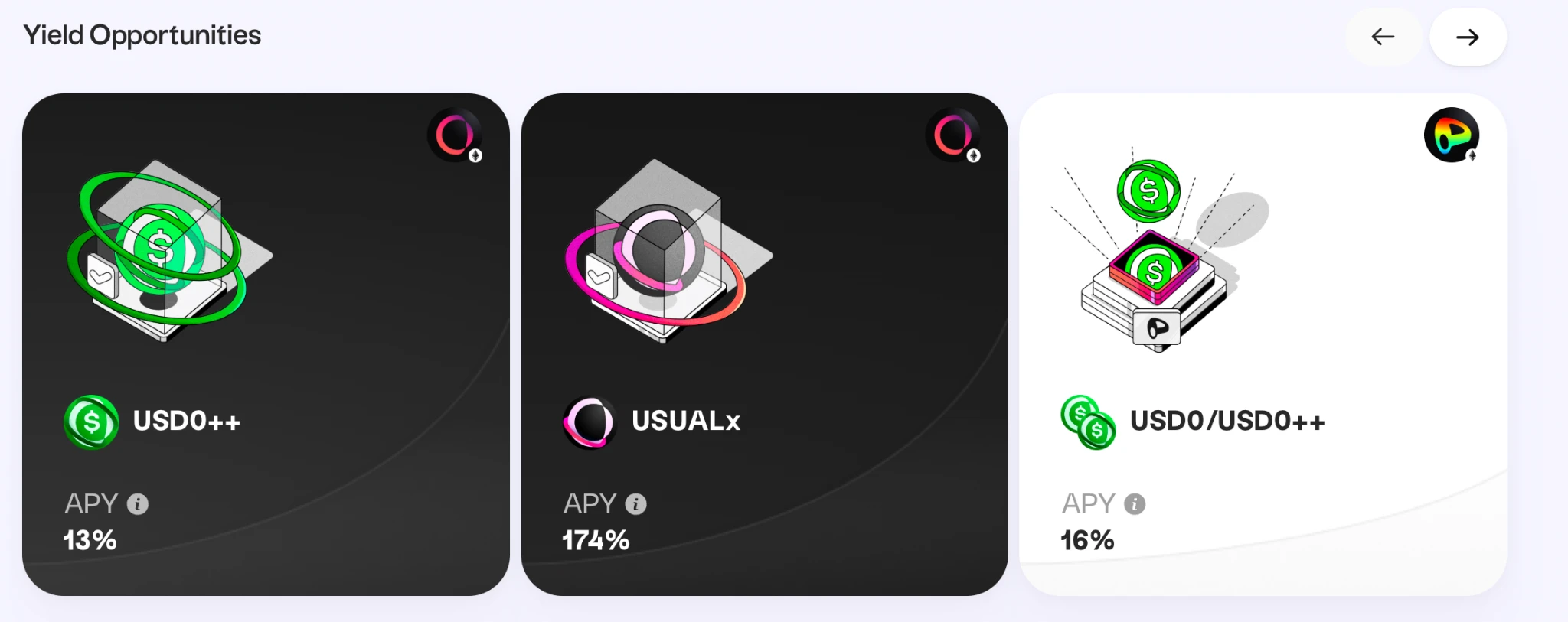

Usual: RWA Yield Catcher

Usual is a decentralized fiat stablecoin issuer that integrates a growing collection of tokenized real-world assets (RWA) from entities such as BlackRock, Ondo, Mountain Protocol, M0, Hashnote, and others into a permissionless, on-chain verifiable, and composable stablecoin, USD0.

Support users to deposit USDC/USDT, users will receive USD 0 at a ratio of 1: 1. The current annualized rate is between 13% and 17%, which changes according to market conditions and is relatively stable.

Solayer: Ecological Bonus Stacker

Solayer provides users with a double benefit opportunity by integrating USDC and Solana chain. Users can get a certain return by depositing USDC, and at the same time participate in other potential projects in the Solana ecosystem. The current APY is around 4%.

4. The author’s actual configuration plan: asset pyramid from defense to offense

In the crypto space, risk management is key. To ensure investment diversity, the following is a personal stablecoin strategy for reference only and does not constitute any investment advice.

Defensive layer (50% funds)

CEX current account guarantee: Binance/OKX deposit and withdrawal pool to cope with sudden liquidity needs

On-chain minimum living security: Solana ecosystem NX Finance (USDT 10.85%), Pluto (USDC 6.19%) and other unissued coin protocols, taking into account both revenue and airdrop expectations.

Offensive layer (30% funds)

Profit combination: The internal distribution of the Pendle protocol is YT:OT = 7:3, with the USDe pool accounting for 60% and the eUSDe pool accounting for 40%, dynamically balancing the risk of interest rate fluctuations.

Exploration Layer (20% Funding)

Blind mining: Small funds participate in the liquidity mining of new protocols, and the investment in a single project does not exceed 5% of the total position.