Original | Odaily Planet Daily ( @OdailyChina )

Author: Azuma ( @azuma_eth )

Just one day had passed since Trump, the “coin ancestor”, loudly “called for” to establish a strategic reserve of cryptocurrency (see “ V-shaped reversal in the crypto market: the “Trump effect” is showing its power again ” for details), but the cryptocurrency market suddenly changed direction, with prices taking a sharp turn for the worse overnight, and the rhythm of the “bull/bear conversion” caught people off guard.

OKX market data shows that BTC once fell below 83,000 USDT (the lowest fell to 82,600 USDT), giving up all the gains after Trumps call. As of around 10:00 (the same below), it was temporarily reported at 83,333.9 USDT, a 24-hour drop of 10.43% .

The altcoin market is even more dire.

The two major copycat coins ETH and SOL both fell by more than 10%, with ETH falling below 2100 USDT, temporarily reported at 2025.83 USDT, a 24-hour drop of 16.28% ; SOL fell below 140 USDT, temporarily reported at 136.3 USDT, a 24-hour drop of 21.05% .

XRP and ADA, which were selected by Trump yesterday, also performed poorly. XRP was temporarily reported at 2.28 USDT, down 18.7% in 24 hours; ADA was temporarily reported at 0.78 USDT, down 27.55% in 24 hours.

There is no need to explain the situation of other altcoins. It is considered an excellent performance if they can maintain a decline within 20%. Most currencies have generally fallen below the lows of the previous days crash.

Alternative data shows that todays Fear and Greed Index has fallen from 33 to 15, and the level has returned to the extreme panic state.

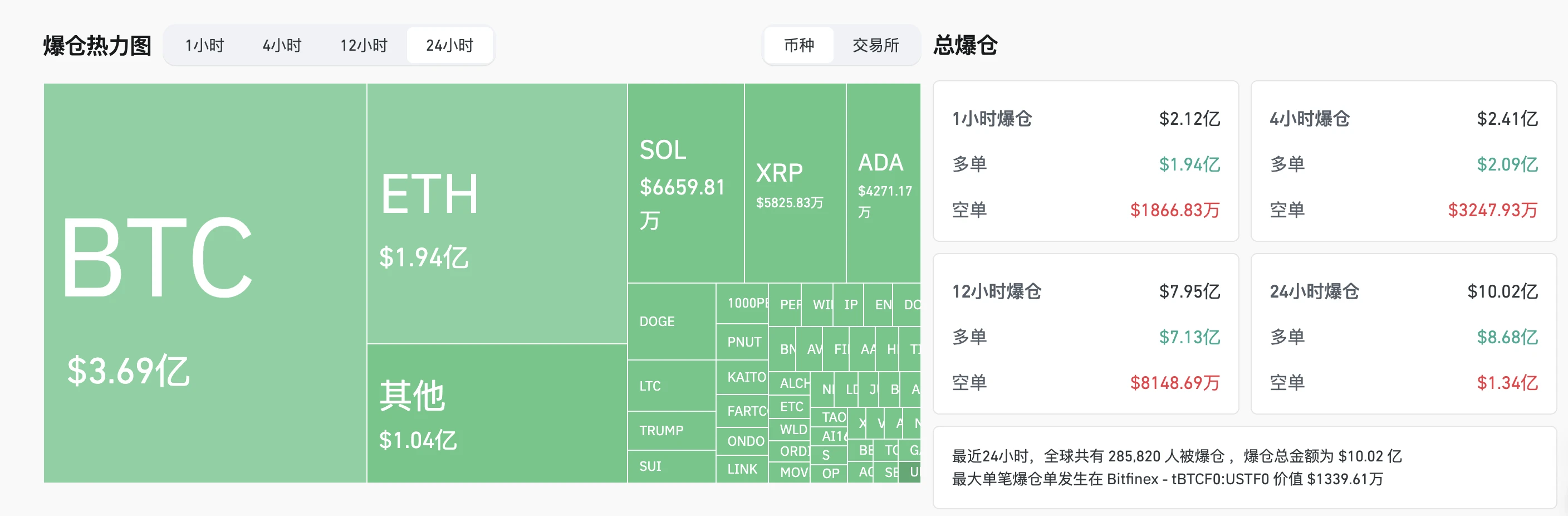

In terms of derivatives data, Coinglass data shows that in the past 24 hours, the entire network has had a liquidation of $1.002 billion , most of which were long orders, amounting to $868 million. In terms of currencies, BTC had a liquidation of $369 million and ETH had a liquidation of $194 million.

Analysis of the causes of the plunge

There are many different opinions in the market about the reasons for the crash, but they can be roughly divided into three categories.

Theory of “Strategic Reserves Are Difficult to Implement”

At present, many institutions/bigwigs have attributed the plunge to the difficulty in strategic reserves of cryptocurrencies. Some of them even warned of the risk of further short-term declines when prices soared yesterday.

Recent bearish investor Arthur Hayes commented yesterday on the “Cryptocurrency Strategic Reserve”: “There’s nothing new here, just hot air. Wait until the Crypto Task Force gets congressional approval to borrow money or revalue gold. Without that, they don’t have the money to buy Bitcoin and altcoins.”

Andrew Tu, head of sales at market maker Efficient Frontier, also said that the details of the cryptocurrency strategic reserve plan are still unknown, including how much the U.S. government will actually buy and how to fund the purchase.

Aurelie Barthere, chief research analyst at Nansen, also warned yesterday that the rise may only be temporary due to the lengthy approval process required to establish U.S. cryptocurrency reserves.

The “Tariff Policy” Theory

In addition to discussions related to strategic reserves, some professionals also attributed the decline to Trumps tariff policy.

Yesterday, Trump announced that he would impose a 25% tariff on Mexican and Canadian goods on Tuesday, which raised concerns about a North American trade war, causing turmoil in financial markets and affecting the cryptocurrency market.

It is worth mentioning that last night the White House announced in advance that Trump will issue a statement on investment, and the crypto market was restless for a while, but the final result was that Trump announced that tariffs will be imposed on imported agricultural products from April 2... The failure of this expectation has also suppressed the markets positive sentiment to a certain extent.

Theory of “U.S. Stock Connectivity”

As the mainstreaming of cryptocurrencies progresses, the relationship between the market and U.S. stocks is getting stronger. Yesterday, the Dow Jones Industrial Average fell 1.48%, the Nasdaq fell 2.64%, and the SP 500 fell 1.76%. Among technology giants, Nvidia fell sharply by 8.69%, Amazon fell more than 3%, and Tesla, Google, and Microsoft all fell more than 2%. In this context, BTC is unlikely to be spared.

Andrew Tu, mentioned above, said yesterday that if the stock market also falls, it may cause cryptocurrency prices to fall again.

Bitfinex also stated in its latest report that broader macro conditions (including the performance of the SP 500) will have a significant impact on Bitcoins performance in the coming weeks. The market remains fragile and sustained bullish momentum may be difficult to achieve without new institutional capital inflows.

How will the market develop in the future?

To be honest, in this monkey market where the market jumps up and down repeatedly and technical analysis is no match for one persons orders, the difficulty index of predicting the future market is rising straight up, and the persuasiveness of various theories seems pale.

Some people have made good predictions recently. For example, Arthur Hayes, who has been bearish until 70,000 and still insisted on bearish during yesterdays short carnival, published a long article predicting the future market this morning (the full text will be compiled and sent out later). The core content is as follows:

I firmly believe that we are still in a bull cycle, so the worst bottom would be the all-time high of the previous cycle at $70,000. I am not sure we will go that low. One positive USD liquidity signal is that the US Treasury General Account is falling, which acts as a liquidity injection.

If this rally is just a dead cat bounce, I expect Bitcoin to fall back to around $80,000, giving us another chance to enter the market. If the SP 500 or Nasdaq 100 fall 20% to 30% from their all-time highs, coupled with the near-bankruptcy of a major financial institution, we could experience a synchronized correction in global markets. At that point, all risk assets would be sold off together, and Bitcoin could fall below $80,000 again, or even pull back to $70,000.

No matter how the market changes, we will be cautious about buying on dips, not using leverage, and patiently waiting for the final violent shock in the fiat financial market. When the global economy recovers under the leadership of the United States, Bitcoin is expected to break through $1 million or even higher.

However, judging from the current situation, believing in a certain prediction theory seems to be less effective than following the insider whale (address: 0xe4d31c2541A9cE596419879B1A46Ffc7cD202c62 ) who once went 50 times long and then sharply turned short. In the past two days, this whale has accurately predicted the sharp fluctuations in the market twice in different directions with extremely high leverage. It is hard to believe that there is no other story behind this.

The market is becoming increasingly difficult. Please operate with caution, conserve your bullets, and exercise restraint in using leverage. After all, only by staying at the table will you have the last laugh.