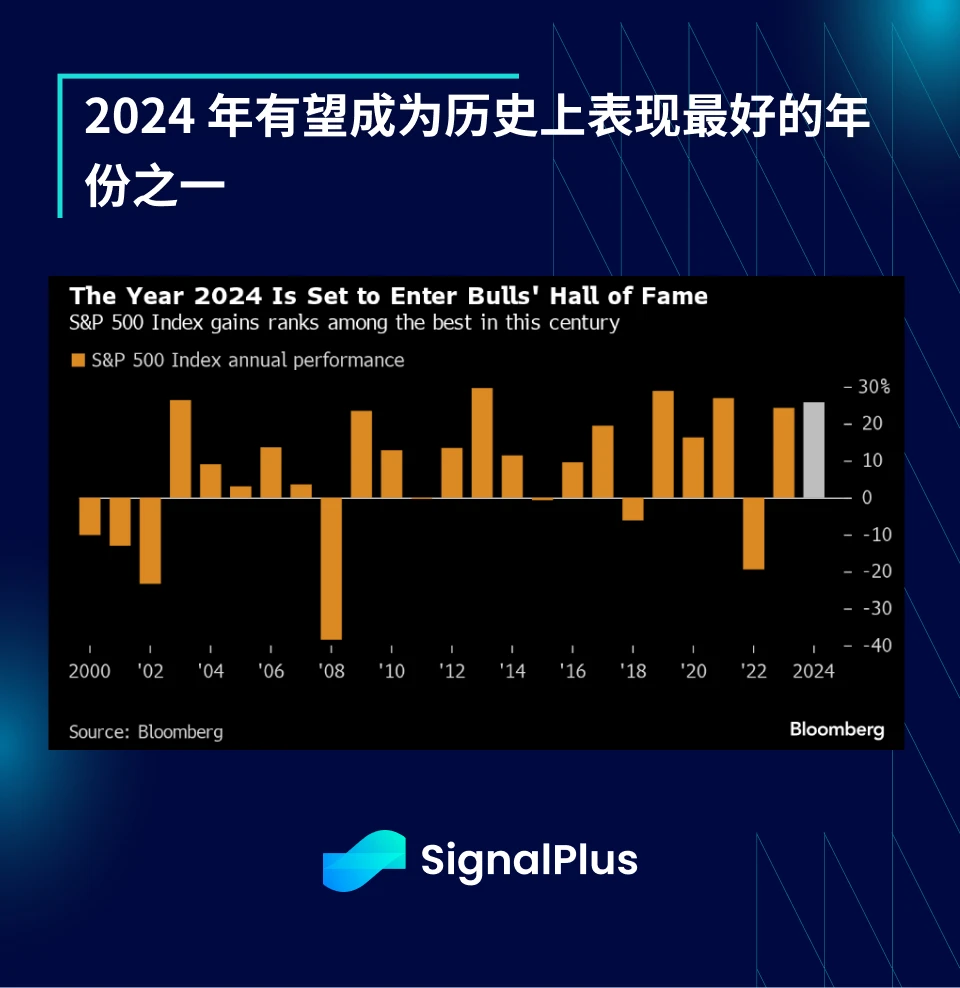

Last week was the Thanksgiving holiday in the United States. The market volume was light and the overall consolidation pattern was maintained. The U.S. stock market is about to make history again. 2024 will be one of the best performing years in history, and the return rate has reached double-digit highs in 5 of the past 6 years.

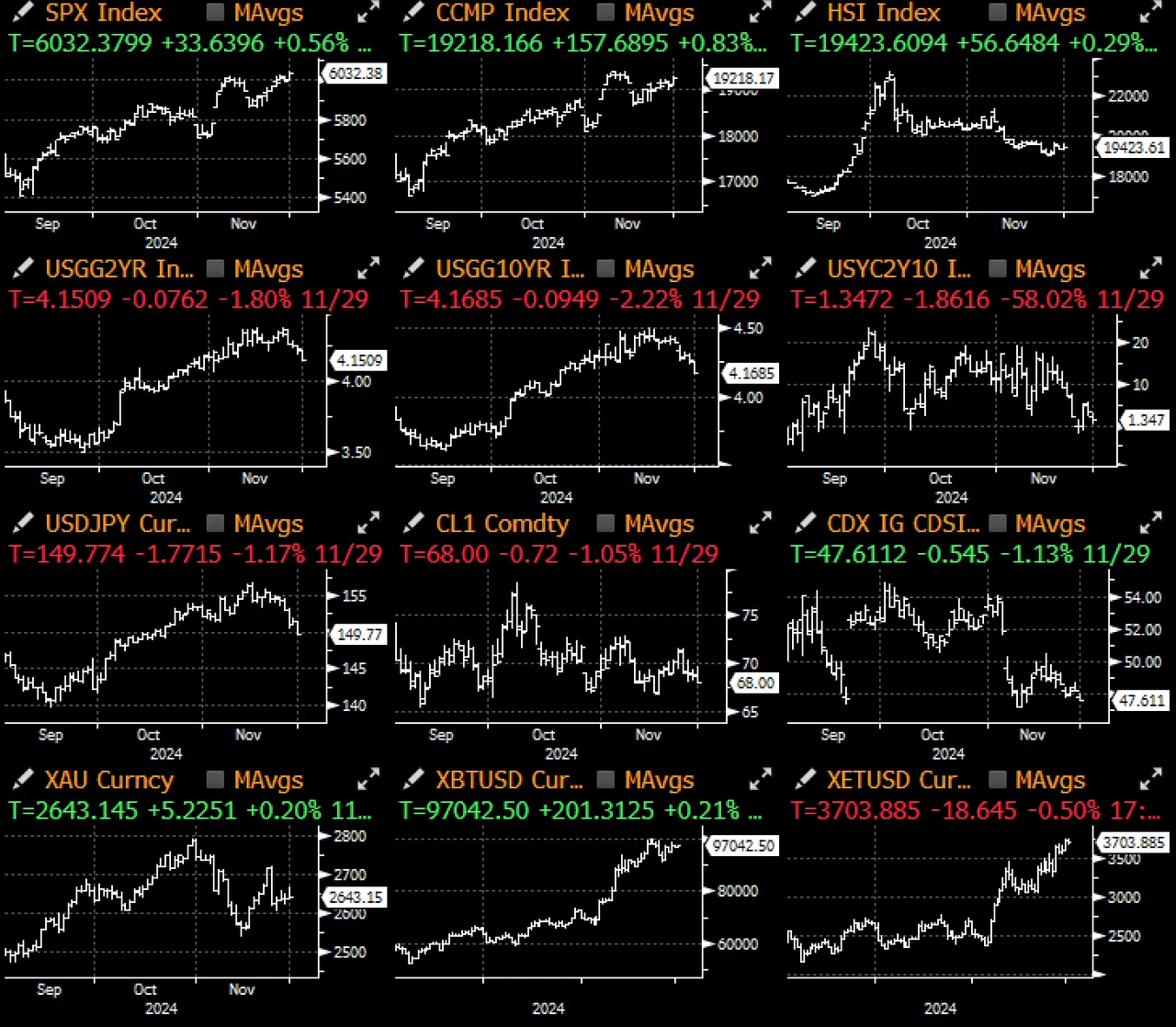

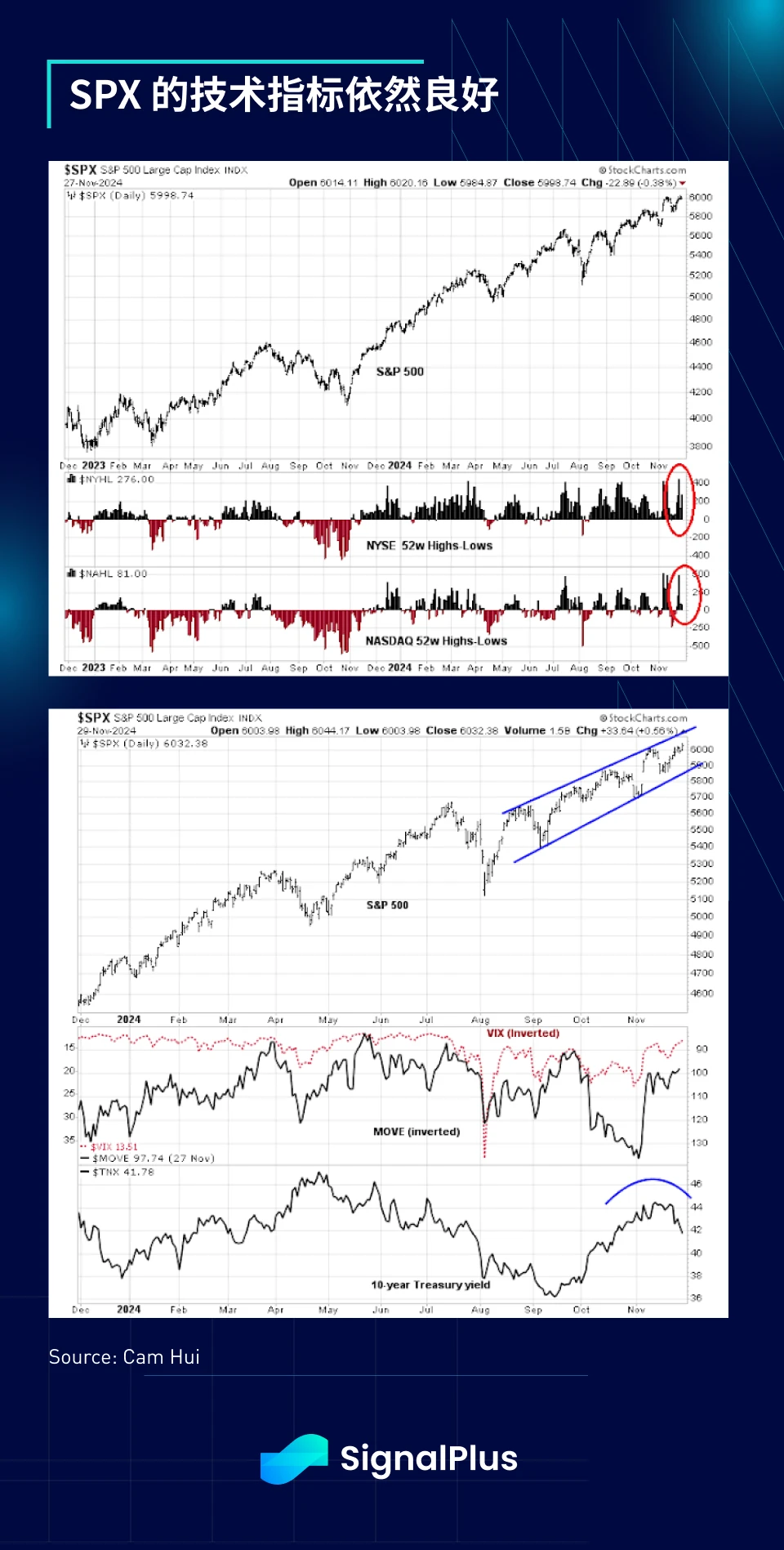

Market breadth remains supportive, the spread between 52-week highs and lows still looks healthy, the uptrend remains intact, the VIX is trending down, while the Treasury market has calmed down after Trump announced Scott Bessent will be Treasury Secretary, with the 10-year yield down nearly 35 basis points from its October high.

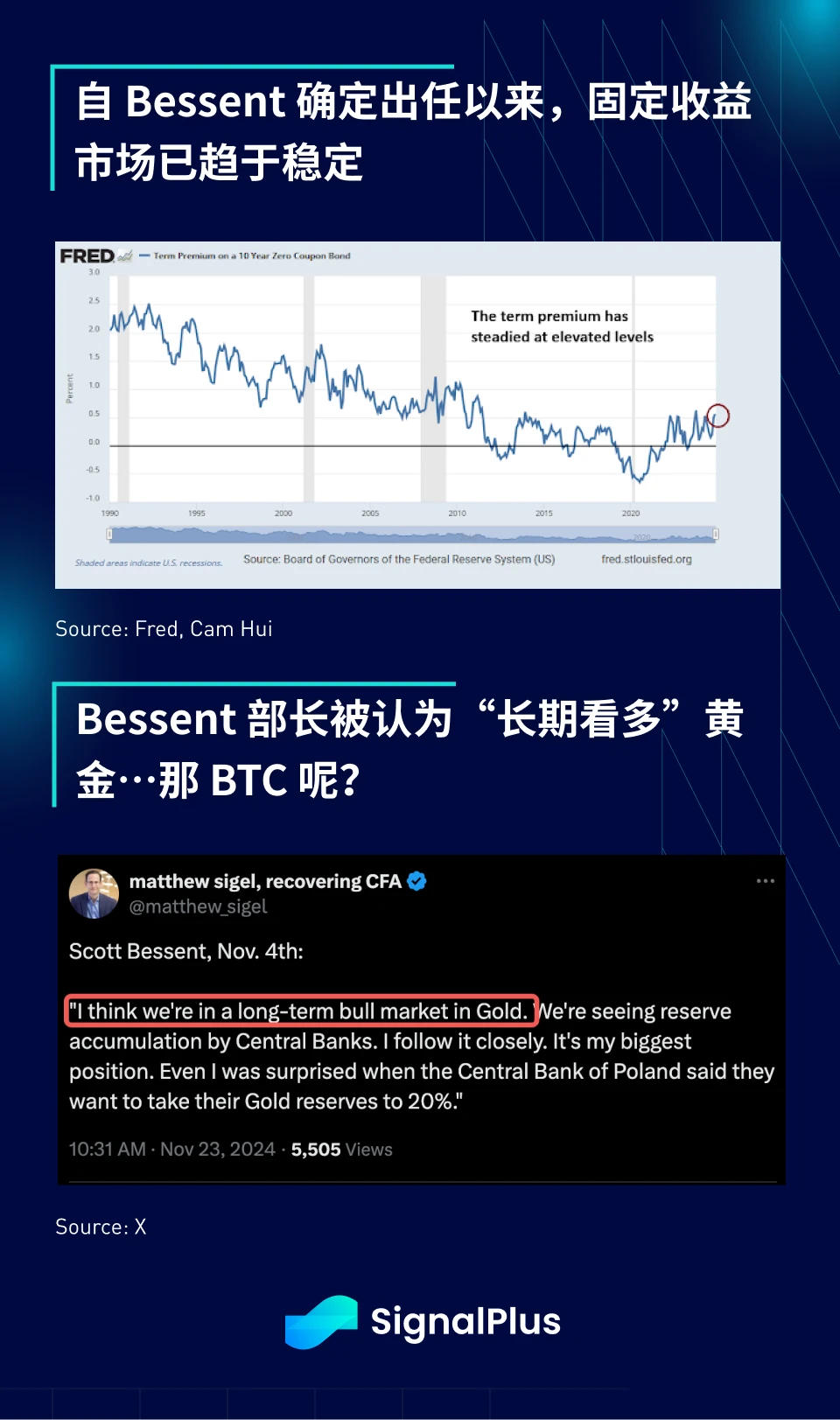

In addition to his so-called pro-crypto stance, Bessent is also a fiscal hawk and a supporter of an independent Federal Reserve. His 3-3-3 plan (reducing the fiscal deficit to 3% of GDP, increasing real GDP growth to 3%, and increasing energy production by 3 million barrels per day) has brought relief to the US fixed income market, and the yield curve premium has stabilized at its current level since his nomination.

While there are still questions about his core arguments, journalists studying his early speeches have noted that he is “long-term bullish” on gold due to continued central bank accumulation. Will this have a spillover effect on Bitcoin, especially with the recent discussion on strategic reserve portfolios? The next 4 years will undoubtedly be very interesting, to say the least.

Traders will return to a busy week with the last non-farm payrolls release of the year. Despite the nascent concerns about a pickup in inflation, the market still sees around a 65% chance of a rate cut, but forward rate cut expectations for 2025-2027 have been significantly reduced given the strong economic conditions. On the employment data, the market expects the headline employment figure to rebound to around +160k, with the unemployment rate remaining around 4.3%. Given the weakness in recent PMI surveys and high-frequency employment data, there is also a chance that the final data result will be lower than expected, but risk sentiment is likely to remain positive unless there is an extremely surprising result.

Optimism remains prevalent across the cryptocurrency market, but the spotlight this week has been on Ripple, with XRP surging by a staggering 73% in anticipation of the government dropping its long-running lawsuit. This remarkable rally has helped XRP surpass USDT to become the third-largest cryptocurrency by market cap. In anticipation of this development, whale addresses have been actively buying (and now selling) XRP over the past month.

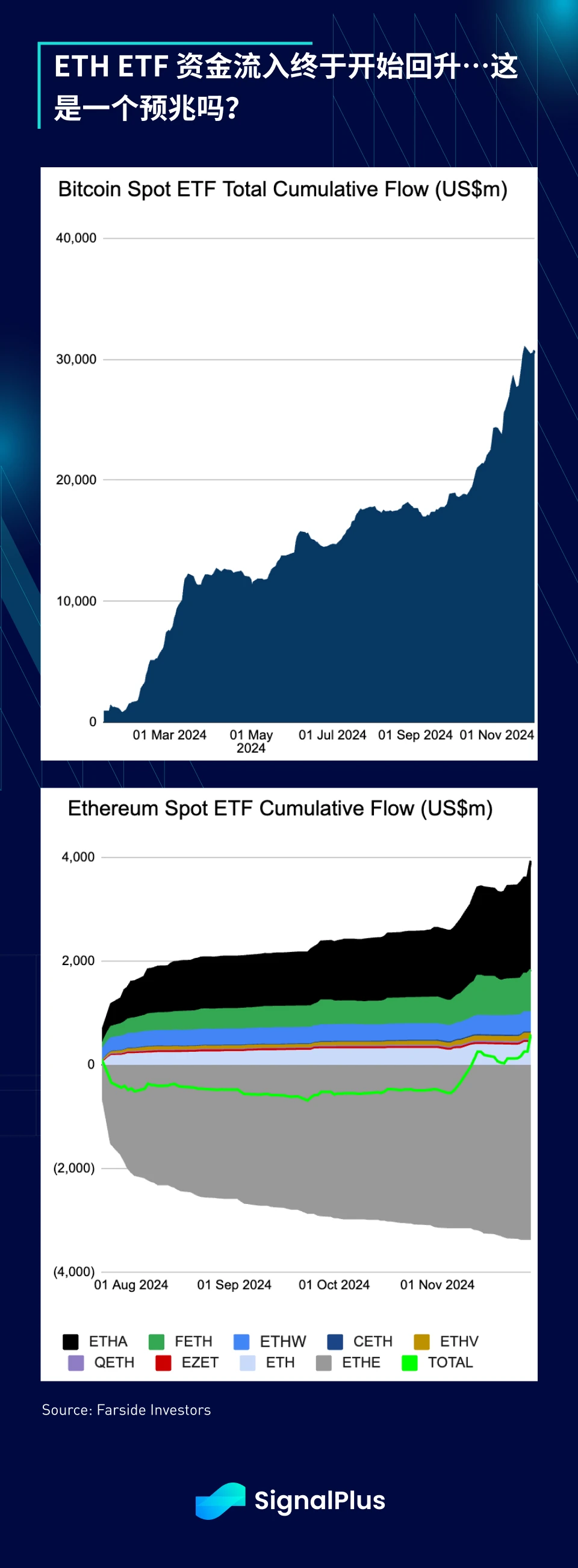

The current rally is mainly concentrated in mainstream coins (excluding ETH), led by BTC, while altcoins are still struggling to return to their January highs. Although the recent success of L2 and protocol transformation blockchains (such as Hyperliquid) still dominates the attention of the cryptocurrency market, we have seen some improvement in Ethereum through the inflow of ETH ETF, with more than $330 million in funds inflow last Friday. Will we see more secondary mainstream coins being driven to rebound before the end of the year?

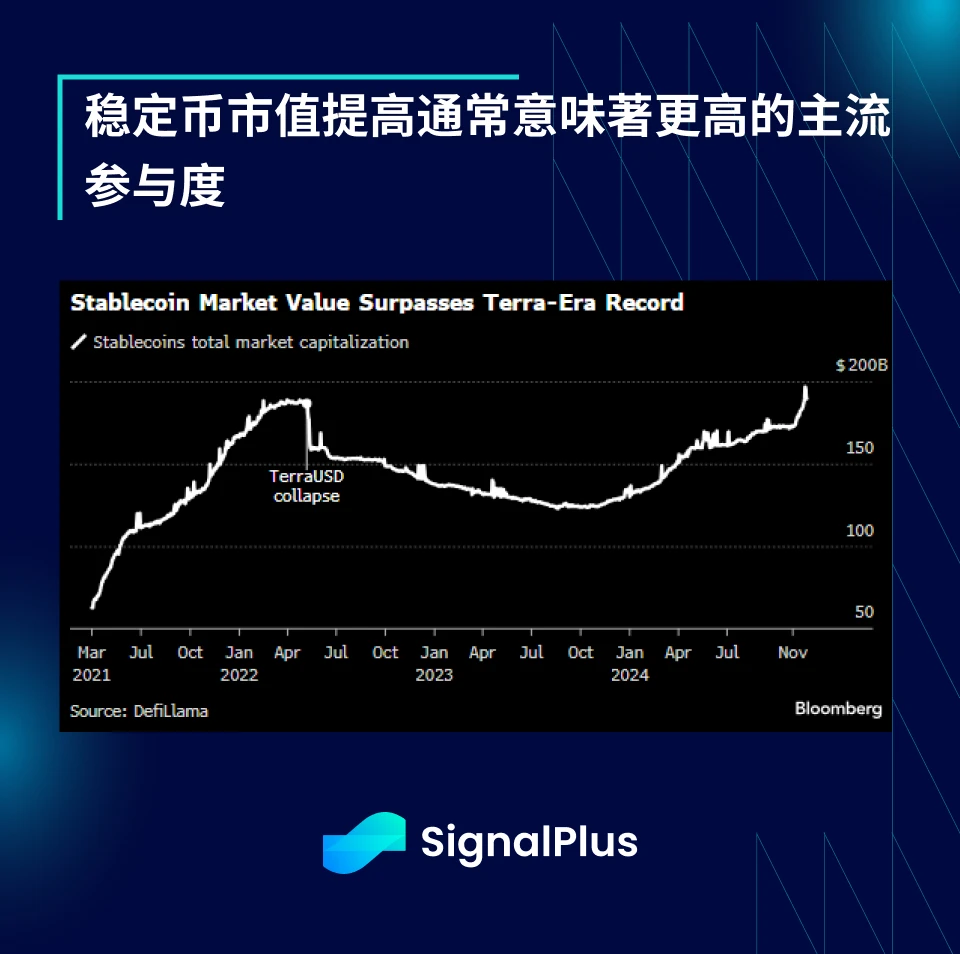

Regardless, fundamental crypto indicators remain positive, with the market cap of stablecoins finally surpassing the highs seen during the Terra-Luna period. Stablecoins are often the first stop for most fiat users into the crypto market, and a higher market cap (which is fixed in price and therefore driven purely by volume) indicates greater mainstream participation.

Will the new year bring even faster growth as investors pour in more new money? Let’s hope so!

You can use the SignalPlus trading vane function at t.signalplus.com to get more real-time crypto information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlusCN, or join our WeChat group (add assistant WeChat: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website: https://www.signalplus.com