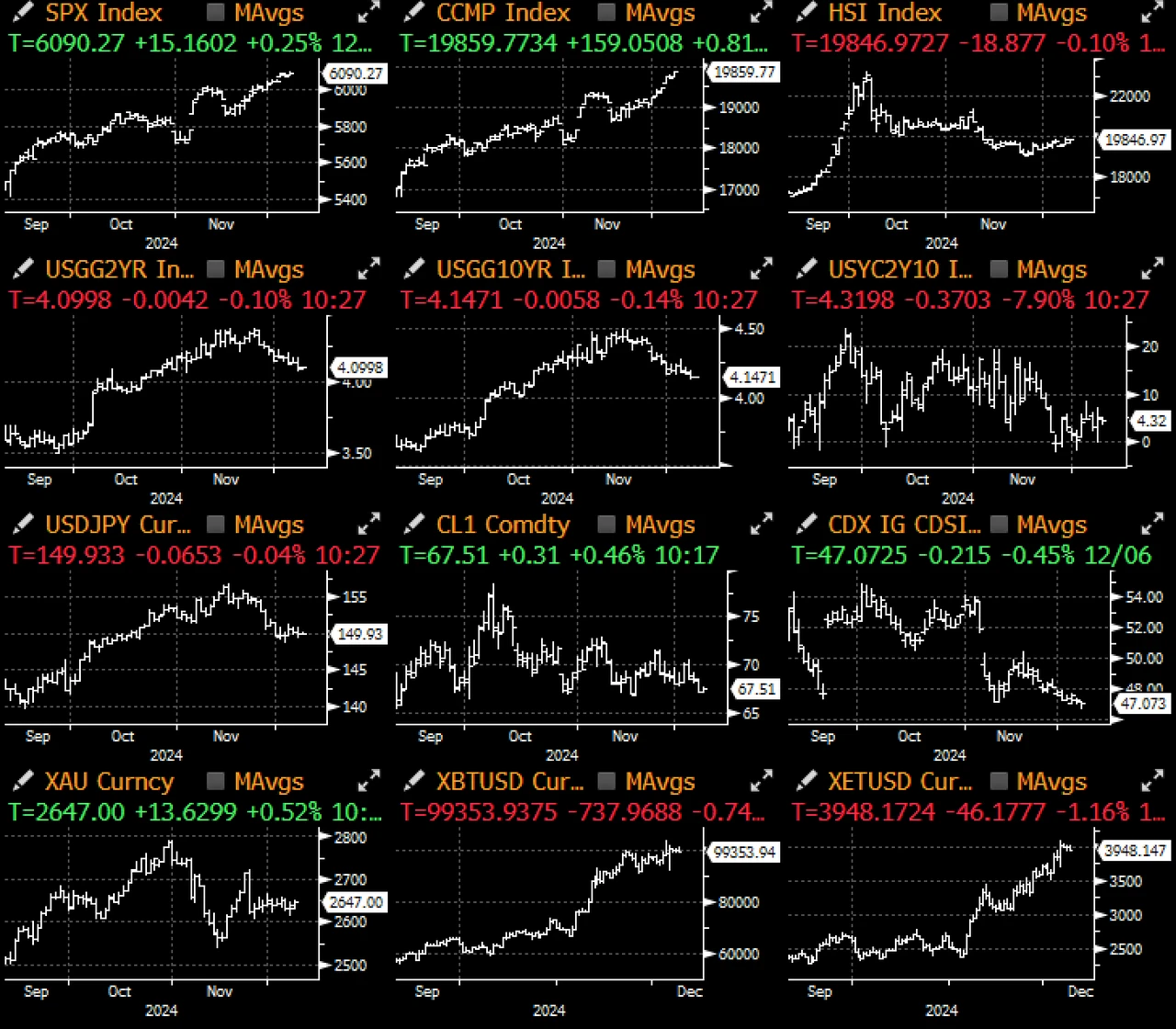

Last Fridays non-farm payrolls report was slightly lackluster, and there is still a high chance of a rate cut in December. The overall non-farm payrolls data was slightly higher than expected, but last months weak data (only 12,000) was barely revised upward, indicating that there are indeed some signs of weakness in the job market. However, the slightly higher unemployment rate shows that the job market is gradually cooling down and has not deteriorated significantly. Against the current positive risk backdrop, this provides support for the Fed to cut interest rates again in December. The market currently expects an 85% chance of a 25 basis point cut in December, while the chance of another cut in January is about 30%.

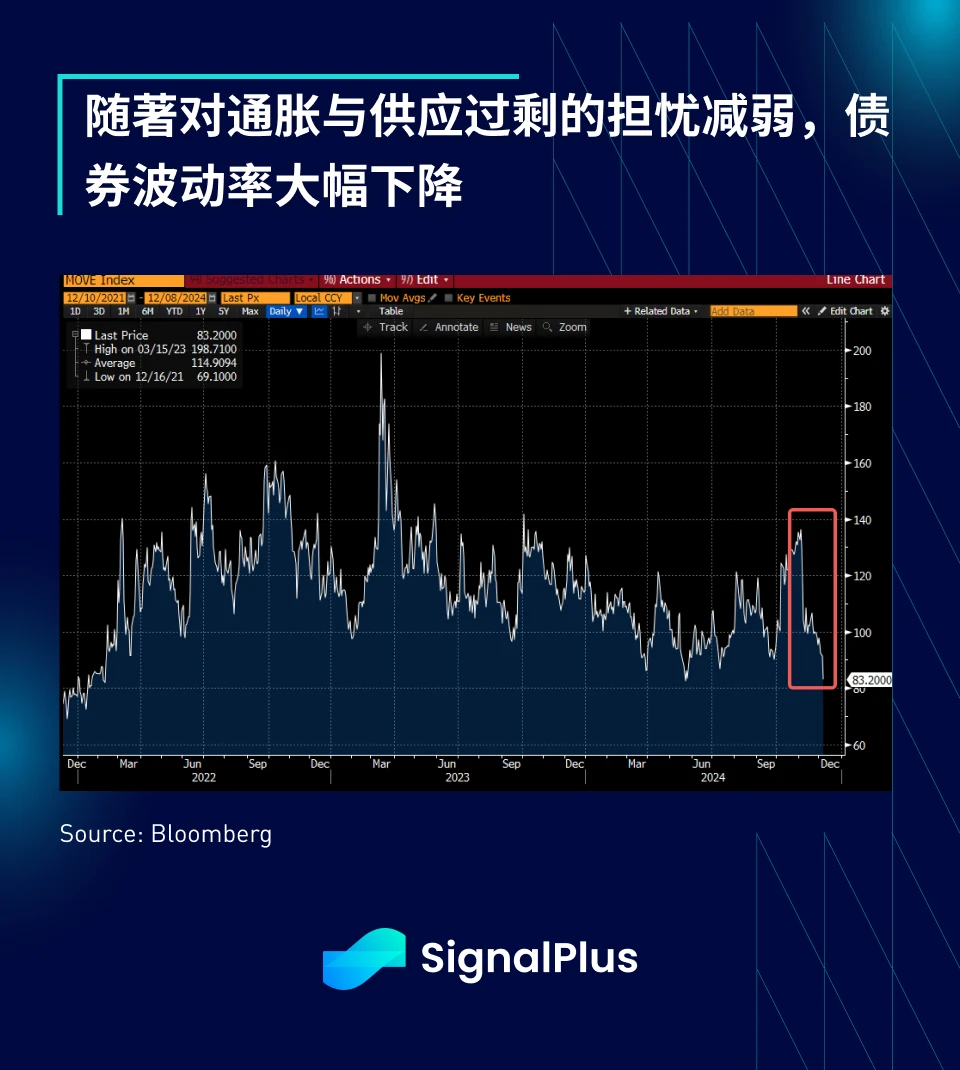

Bond volatility fell to a multi-year low and yields fell further, with the 2-year yield approaching 4% and the 10-year returning to 4.15%. Before the FOMC meeting, the market will usher in the release of CPI and PPI data, which are the last important economic data before the end of the year. As Trump 2.0 policies gradually take shape, the yield curve may steepen again.

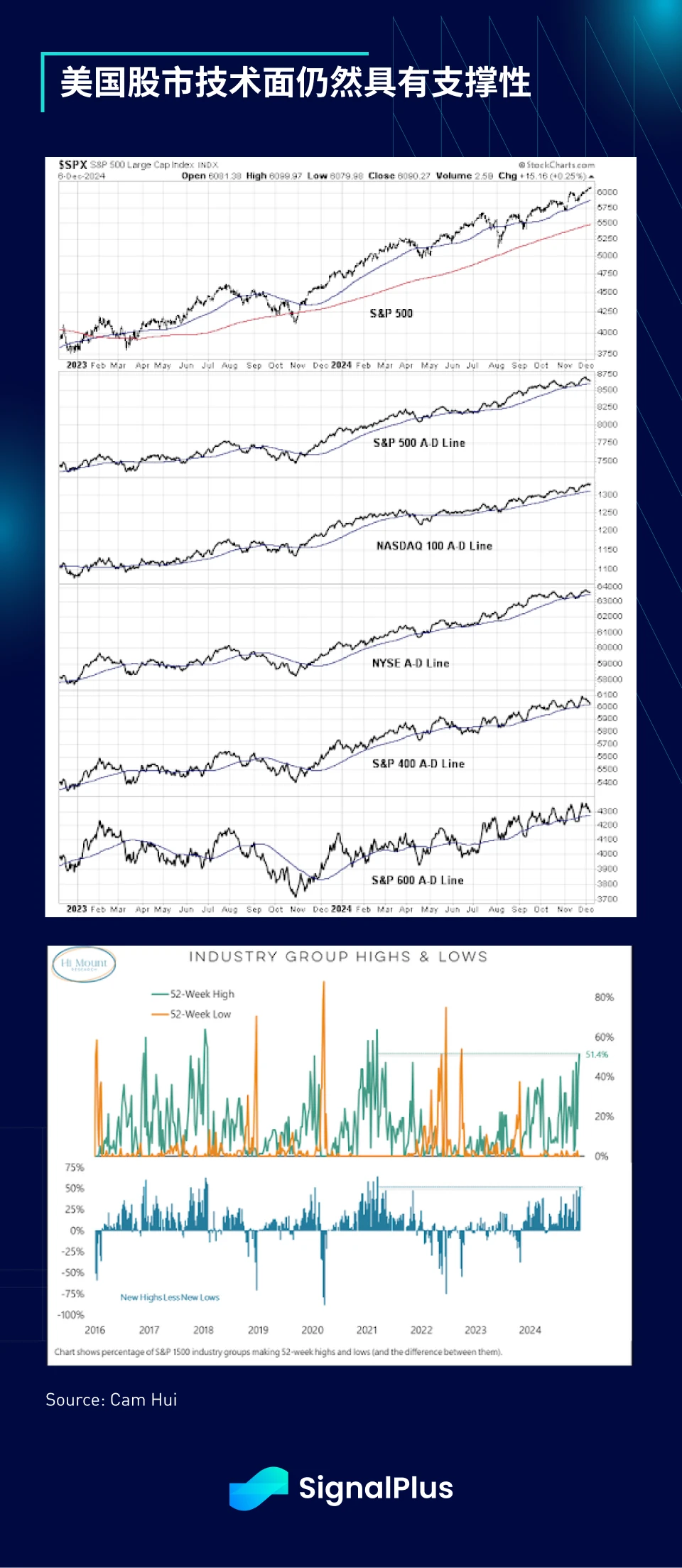

As for US stocks, due to favorable data and dovish performance of the bond market, US stocks are approaching new historical highs again. The technical side is still supportive, the AD Index continues to move to the upper right, and the number of stocks that hit a 52-week high still exceeds the new low, and the stock market has risen across the board.

Interestingly, risk appetite is so prevalent that growth stocks are once again outperforming value stocks, which is relatively rare in the late stages of economic growth. Is this a contrarian signal that the current market is overheated, or is it an early sign that the market may usher in a new round of gains in January? To be sure, any form of short position faces huge risks in the current market...

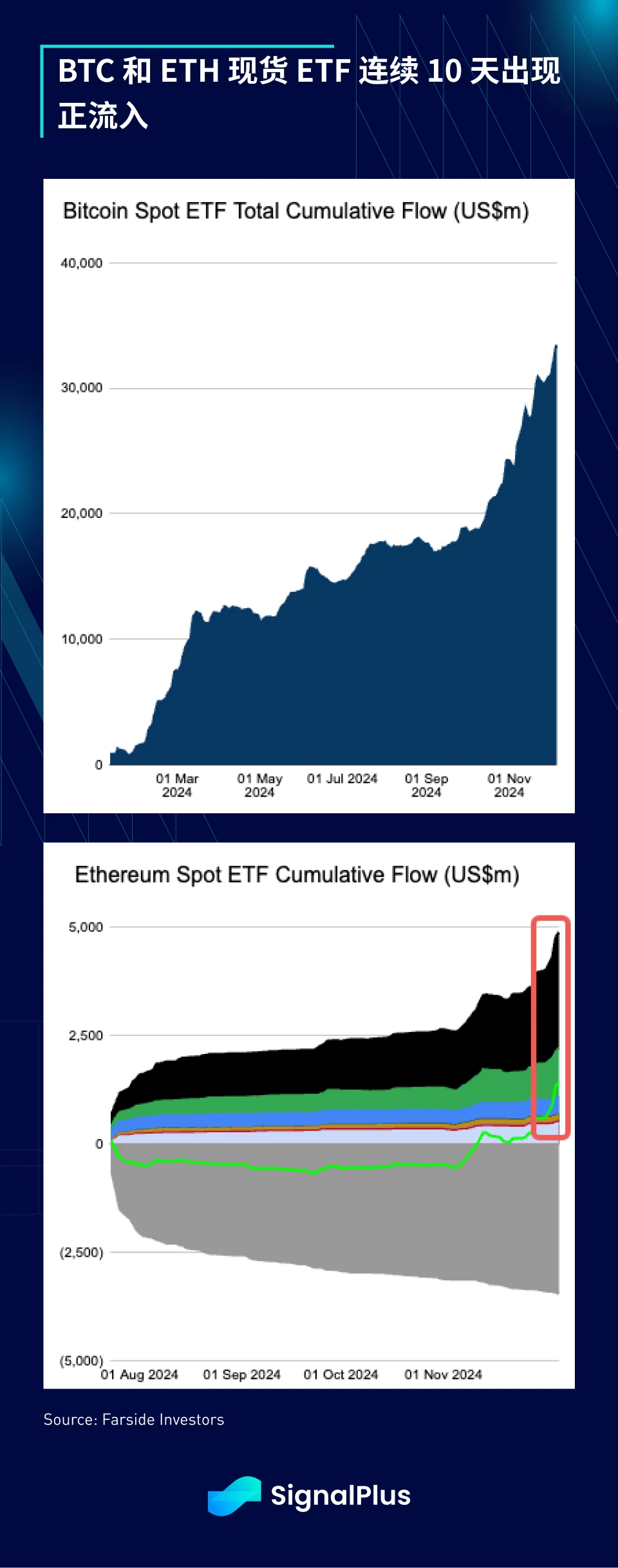

In crypto, indicators are positive across the board, with BTC closing near $100,000 again and ETH expected to break $4,000. ETF inflows were huge, with BTC ETFs adding $2.7 billion and ETH ETFs adding $800 million, respectively, with positive inflows for 10 consecutive days. TradFi inflows remain the dominant factor behind spot performance, with a cumulative inflow of about $12 billion since the election. Meanwhile, Blackrock and Microstrategy have quietly become the largest BTC holders in the market, holding nearly 1 million BTC in total, permanently changing the markets supply and landscape.

Finally, as the market bullish sentiment continues, the funding rate of perpetual contracts remains relatively high, with annualized rates exceeding 20% on major exchanges. The BTC volatility curve also shows a strong bullish skew, but sell-side strategies remain popular and overall volatility remains stable.

You can use the SignalPlus trading vane function at t.signalplus.com to get more real-time crypto information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlusCN, or join our WeChat group (add assistant WeChat: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website: https://www.signalplus.com